This is one of the best videos on Bitcoin for newbies to watch. You don't have to know all the details--you just have to know who's on the bus, and why they're on

Thursday, December 31, 2020

M1 and M2 Data Merging

Minimum Wage vs. Gold Comparison

This is why too much money printing makes most people poorer. The dollar is getting destroyed and wages aren't keeping up.

Wednesday, December 30, 2020

Bitcoin Surges To New Record High Near $29k Amid "Liquidity Crisis"

Bitcoin is not in a bubble. Applying technical analysis and reading chart patterns alone on Bitcoin will bankrupt you.

https://www.zerohedge.com/crypto/bitcoin-surges-new-record-high-near-29k-amid-liquidity-crisis

Sunday, December 27, 2020

Former Fed Chair Burns Memo to President Ford

Governments manipulate markets--especially precious metals, to maintain power. Conspiracy theory? Think again.

http://www.gata.org/files/ArthurBurnsLetterToPresidentFord-June1975.pdf

Monday, December 14, 2020

Saturday, December 5, 2020

Why Does Bitcoin Have Value?

This is a great article on Bitcoin, much better than my attempt to explain it in 2013.

Friday, November 27, 2020

Falsifying Stock-to-Flow As a Model of Bitcoin Value

Eigenvalues are not proof-negative that the Bitcoin stock-to-flow model is legit. Translation: the price of Bitcoin will inevitably go higher over time.

https://medium.com/coinmonks/falsifying-stock-to-flow-as-a-model-of-bitcoin-value-b2d9e61f68af

Tuesday, November 24, 2020

Crypto will be useful but Bitcoin is hard to understand, says SoftBank CEO

In the Misdirection category, the title of these articles about the Softbank CEO implies that he is not a fan of Bitcoin. However, I have personally seen first-hand one of Softbank's huge Bitcoin mining farms. It's not in China, not in Japan, but in good ol' Texas (I cannot reveal the exact location). These mining farms cost north of $150 million to build. The data centers are clustered over 100 acres.

Friday, November 20, 2020

Sunday, November 15, 2020

Thursday, November 12, 2020

Wednesday, November 11, 2020

Wednesday, October 21, 2020

Multiple Banks are Bullish on Gold and Silver

Thursday, September 3, 2020

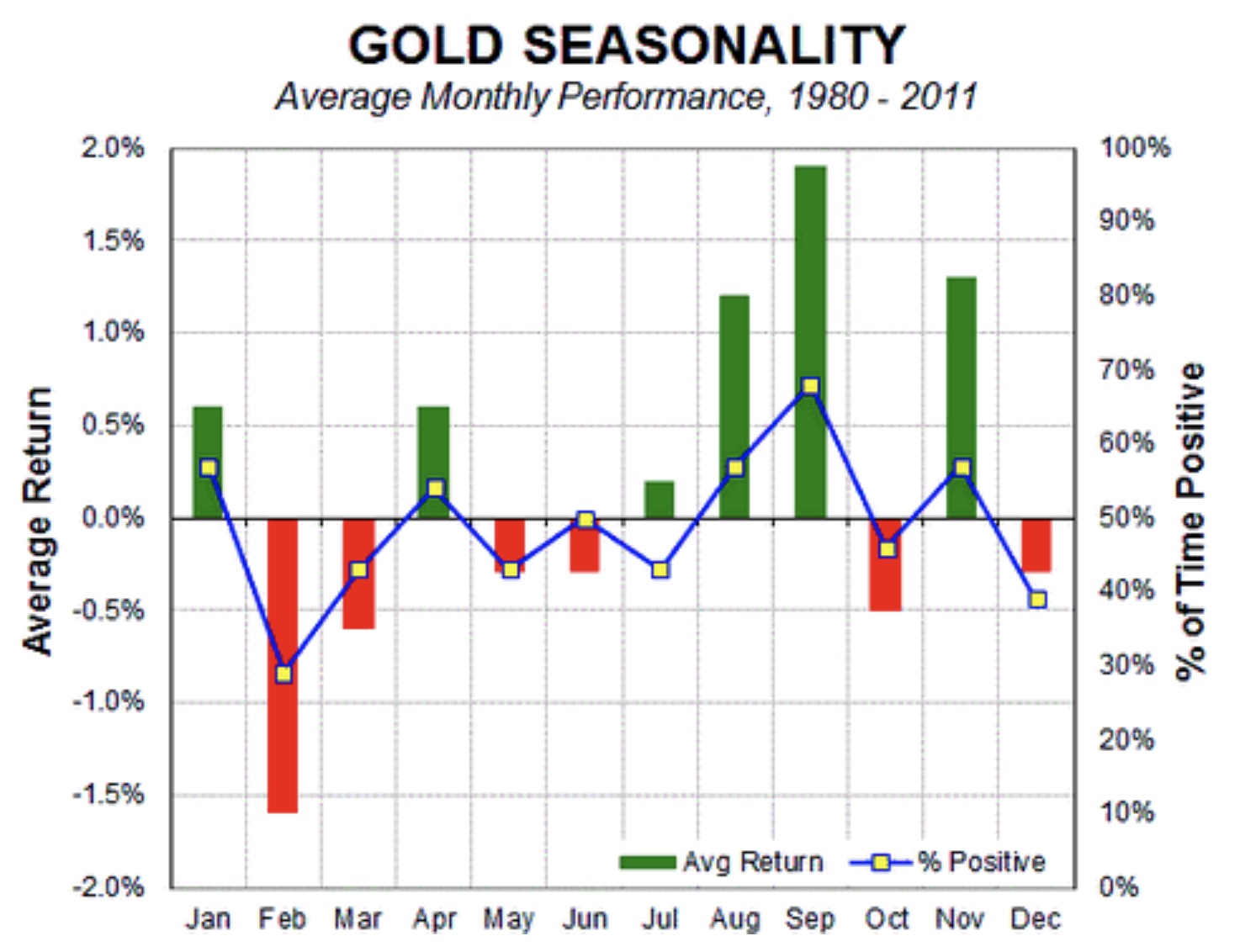

Jobs Friday (and Its Effect on Gold and Silver)

I posted this on September 1, 2017 regarding "jobs Friday." It's still relevant today, even as gold and silver plummet on the Thursday before Jobs Friday tomorrow.

My letter to clients:

I posted this two days ago on Facebook and LinkedIn, and it's a shared memory from September 1, 2017.

Wednesday, August 26, 2020

Monday, August 24, 2020

Tuesday, August 18, 2020

Monday, August 17, 2020

Thursday, August 13, 2020

Tuesday, August 11, 2020

Sunday, July 26, 2020

When to Exit Precious Metals Equities

Precious metals mining equities are the last to enter into a bull market, and utilities are the first to enter into the next cycle.

Saturday, July 25, 2020

Tuesday, July 14, 2020

Tuesday, June 23, 2020

Saturday, June 20, 2020

Wednesday, June 17, 2020

Tuesday, June 16, 2020

Saturday, June 13, 2020

Friday, June 12, 2020

FT's John Dizard: The global gold market is breaking up

I didn't know this.

Vietnam is among the top three gold trading countries, with 60 to 70 tonnes per year, and only behind Thailand and Indonesia with 80 to 90 tonnes per year. Over the years Vietnamese have imported nearly 850 tonnes of gold.

Sunday, May 24, 2020

Around the Block #4: on the recent market crash and Bitcoin’s value proposition

https://blog.coinbase.com/on-crypto-markets-and-bitcoins-value-proposition-2fbbca5349dd

Tuesday, May 19, 2020

Friday, May 15, 2020

Wednesday, May 13, 2020

Sunday, May 10, 2020

Friday, May 8, 2020

Alasdair Macleod – Global Fiat Currencies Will Burn While Gold & Silver Skyrocket

Eventually, Bitcoin will be priced in gold. Because of its deflationary cap of 21 million, Bitcoin would probably still rise relative to gold, but with far less volatility.

https://kingworldnews.com/alasdair-macleod-global-fiat-currencies-will-burn-while-gold-silver-skyrocket/

Monday, April 27, 2020

What Crash?? Buy Tankers…

https://adventuresincapitalism.com/2020/03/13/ignore-the-market-crash-and-buy-tankers/

Here's a video explaining the play on tankers:

https://www.realvision.com/opportunity-in-the-covid-crude-oil-contango?utm_source=contributor&utm_medium=referral&utm_campaign=43916_HK_GH_CONT_W1_LINK

Sunday, April 12, 2020

The Fed's Cure Risks Being Worse Than the Disease

The economic debate of the day centers on whether the cure of an economic shutdown is worse than the disease of the virus. Similarly, we need to ask if the cure of the Federal Reserve getting so deeply into corporate bonds, asset-backed securities, commercial paper, and exchange-traded funds is worse than the disease seizing financial markets. It may be.

In just these past few weeks, the Fed has cut rates by 150 basis points to near zero and run through its entire 2008 crisis handbook. That wasn’t enough to calm markets, though — so the central bank also announced $1 trillion a day in repurchase agreements and unlimited quantitative easing, which includes a hard-to-understand $625 billion of bond buying a week going forward. At this rate, the Fed will own two-thirds of the Treasury market in a year.

- CPFF (Commercial Paper Funding Facility) – buying commercial paper from the issuer.

- PMCCF (Primary Market Corporate Credit Facility) – buying corporate bonds from the issuer.

- TALF (Term Asset-Backed Securities Loan Facility) – funding backstop for asset-backed securities.

- SMCCF (Secondary Market Corporate Credit Facility) – buying corporate bonds and bond ETFs in the secondary market.

- MSBLP (Main Street Business Lending Program) – Details are to come, but it will lend to eligible small and medium-size businesses, complementing efforts by the Small Business Association.

So how can they do this? The Fed will finance a special purpose vehicle (SPV) for each acronym to conduct these operations. The Treasury, using the Exchange Stabilization Fund, will make an equity investment in each SPV and be in a “first loss” position. What does this mean? In essence, the Treasury, not the Fed, is buying all these securities and backstopping of loans; the Fed is acting as banker and providing financing. The Fed hired BlackRock Inc. to purchase these securities and handle the administration of the SPVs on behalf of the owner, the Treasury.

In other words, the federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades.

This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.

In 2008 when something similar was done, it was on a smaller scale. Since few understood it, the Bush and Obama administrations ceded total control of those acronym programs to then-Fed Chairman Ben Bernanke. He unwound them at the first available opportunity. But now, 12 years later, we have a much better understanding of how they work. And we have a president who has made it very clear how displeased he is that central bankers haven’t used their considerable power to force the Dow Jones Industrial Average at least 10,000 points higher, something he has complained about many times before the pandemic hit.

When the Fed was rightly alarmed by the current dysfunction in the fixed-income markets, they felt they needed to act. This was the correct thought. But, to get the authority to stabilize these “private” markets, central bankers needed the Treasury to agree to nationalize (own) them so they could provide the funds to do it.

In effect, the Fed is giving the Treasury access to its printing press. This means that, in the extreme, the administration would be free to use its control, not the Fed’s control, of these SPVs to instruct the Fed to print more money so it could buy securities and hand out loans in an effort to ramp financial markets higher going into the election. Why stop there? Should Trump win re-election, he could try to use these SPVs to get those 10,000 Dow Jones points he feels the Fed has denied everyone.

If these acronym programs were abused as I describe, they might indeed force markets higher than valuation warrants. But it would come with a heavy price. Investors would be deprived of the necessary market signals that freely traded capital markets offer to aid in the efficient allocation of capital. Malinvestment would be rampant. It also could force private sector players to leave as the government’s heavy hand makes operating in “controlled” markets uneconomic. This has already occurred in the U.S. federal funds market and the government bond market in Japan.

Fed Chair Jerome Powell needs to tread carefully indeed to ensure his cure isn’t worse than the disease.

Wednesday, April 1, 2020

Supplies Are Starting To Get Really Tight Nationwide As Food Distribution Systems Break Down

https://twitter.com/andrewrush/status/1244657465859457024?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1244657465859457024&ref_url=http%3A%2F%2Fendoftheamericandream.com%2Farchives%2Fsupplies-are-starting-to-get-really-tight-nationwide-as-food-distribution-systems-break-down

Saturday, March 28, 2020

Thursday, March 26, 2020

Monday, March 23, 2020

BREAKING: Egon von Greyerz Just Warned Swiss Refiners Have Halted Gold Production!

We must remember that 70% of all gold bars are produced in Switzerland and that the 3 biggest refiners are in Ticino where the local government has ordered non-essential factories to close.

The likely outcome of gold production stopping should be a much higher gold price on Monday. But we obviously don’t know if the BIS and the bullion banks will hit the gold market with $ billions of paper gold. Whatever they do in the short run, the market will soon discover that all this paper gold is worthless.

The gold mining stocks are also likely to suffer until the situation is clarified since they have lost their biggest buyers.

Please remember that the principal reason to hold physical metals is for insurance and wealth preservation.